Table of Contents

- Introduction to Progressive Insurance

- History and Growth of Progressive Insurance

- Types of Insurance Policies Offered

- Auto Insurance: Features and Benefits

- Homeowners and Renters Insurance

- Commercial Insurance Solutions

- Motorcycle, Boat, and RV Insurance

- Unique Features and Technological Innovations

- Progressive’s Competitive Pricing and Discounts

- Customer Experience and Claims Process

- Progressive’s Financial Strength and Market Position

- Community Involvement and Corporate Responsibility

- Challenges and Areas for Improvement

- Conclusion

1. Introduction to Progressive Insurance

Progressive Insurance is one of the leading insurance companies in the United States, offering a wide range of insurance products to individuals and businesses. Known for its innovative approach to insurance, Progressive has gained a reputation for affordability, flexibility, and customer-centric services.

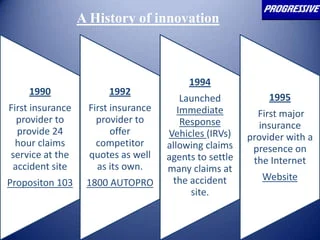

2. History and Growth of Progressive Insurance

Progressive was founded in 1937 by Joseph Lewis and Jack Green with the vision of providing vehicle insurance that is both accessible and affordable. Over the decades, the company has grown significantly, becoming a household name in the insurance industry. It was one of the first insurance companies to introduce a drive-in claims service and has continued to lead the way in digital innovation.

3. Types of Insurance Policies Offered

Progressive offers a variety of insurance products, including:

- Auto Insurance

- Homeowners Insurance

- Renters Insurance

- Commercial Insurance

- Motorcycle Insurance

- Boat and Watercraft Insurance

- RV Insurance

- Life Insurance

- Pet Insurance

Each of these policies is designed to meet the specific needs of policyholders.

4. Auto Insurance: Features and Benefits

Auto insurance is Progressive’s flagship product, providing coverage for millions of drivers. Some of the key features include:

- Liability Coverage: Covers bodily injury and property damage.

- Comprehensive and Collision Coverage: Protects against theft, vandalism, and accidents.

- Uninsured/Underinsured Motorist Coverage: Safeguards drivers in case of accidents with uninsured motorists.

- Roadside Assistance: Provides emergency support for breakdowns.

- Usage-Based Insurance: The Snapshot program helps drivers save based on driving habits.

5. Homeowners and Renters Insurance

Progressive provides both homeowners and renters insurance with coverage for:

- Property damage from fire, wind, and other hazards.

- Personal liability protection.

- Additional living expenses if a home becomes uninhabitable.

- Personal property coverage for valuable belongings.

6. Commercial Insurance Solutions

Progressive offers various insurance solutions for businesses, including:

- Commercial auto insurance for business vehicles.

- General liability insurance to protect against claims.

- Workers’ compensation insurance.

- Professional liability insurance for service providers.

7. Motorcycle, Boat, and RV Insurance

For outdoor and adventure enthusiasts, Progressive provides specialized insurance for motorcycles, boats, and RVs. These policies include:

- Collision and comprehensive coverage.

- Roadside assistance and towing services.

- Special coverage for accessories and custom parts.

- Emergency expense coverage for RV users.

8. Unique Features and Technological Innovations

Progressive has been a pioneer in integrating technology into insurance services. Notable innovations include:

- Snapshot Program: A telematics-based program that rewards safe drivers with discounts.

- Name Your Price Tool: Helps customers find a policy that fits their budget.

- Mobile App and Online Tools: Enable policy management, claims filing, and bill payments.

9. Progressive’s Competitive Pricing and Discounts

Progressive offers a variety of discounts to help customers save on their premiums, such as:

- Multi-policy discount

- Safe driver discount

- Good student discount

- Pay-in-full discount

- Paperless billing discount

- Continuous insurance discount

10. Customer Experience and Claims Process

Progressive has streamlined its claims process to make it as simple as possible. Customers can file claims through:

- The Progressive website

- Mobile app

- 24/7 customer service hotline

Progressive also offers a network of repair shops, ensuring fast and efficient service.

11. Progressive’s Financial Strength and Market Position

As one of the largest auto insurers in the U.S., Progressive has a strong financial foundation. The company consistently receives high ratings from agencies like A.M. Best, Moody’s, and Standard & Poor’s, reflecting its stability and ability to pay claims efficiently.

12. Community Involvement and Corporate Responsibility

Progressive is committed to giving back to the community through various initiatives, including:

- Donations and grants to nonprofit organizations.

- Employee volunteer programs.

- Environmental sustainability efforts.

13. Challenges and Areas for Improvement

Despite its strengths, Progressive faces challenges, such as:

- Higher premiums for some demographics.

- Mixed customer reviews on claim resolutions.

- Competition from emerging insurtech companies.

14. Conclusion

Progressive Insurance remains a top choice for millions of customers due to its affordability, technological innovations, and wide range of coverage options. While it has areas for improvement, its strong market presence and commitment to customer satisfaction make it a reliable choice for insurance coverage.